2022 6000 Gvwr Deduction List

2022 6000 Gvwr Deduction List

2017 2018 LIST OF VEHICLES WITH LOADED GVWR EXCEEDING 6000 POUNDS AND THEREFORE QUALIFY FOR SPECIAL TAX STATUS. Year 1 3160 3460. Metris Class 4222 6724 Sprinter 6382 11030 Armada 5576 7300 NV Cargo NV1500 5791 8550 NV Cargo NV2500 HD 5810 9100 NV Cargo NV3500 HD 5878 9900 NV Passenger NV3500 HD 6697 9520 Titan 5935 7300 Porsche Cayenne 4488 6195 ProMaster 1500 Cargo. Provided your business income before the deduction is 75000 or more.

6 000 Pound Vehicle List Special Irs Depreciation Tax Benefit Diminished Value Of Georgia

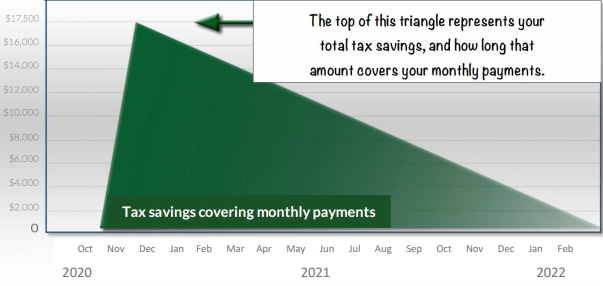

In 2021 the total write-off amount was limited to 1050000 and the entire deduction is eliminated if equipment and vehicles reach 3630000.

2022 6000 Gvwr Deduction List. Cars Vans and Light Trucks. The dollar amount is adjusted each year for inflation. Any unused amount would be carried over to 2020.

Section 179 tax deduction limit. Vehicles with a fully-enclosed cargo area. Section 179 does limit the total amount that can be deducted.

I hope somebody can help me. Heavy SUVs Pickups and Vans that are more than 50 business-use and exceed 6000 lbs. Namely any SUV pick-up truck or another transportation tool that weighs between 6000 and 14000 pounds will qualify for a Section 179 deduction that carries a 25000 ceiling.

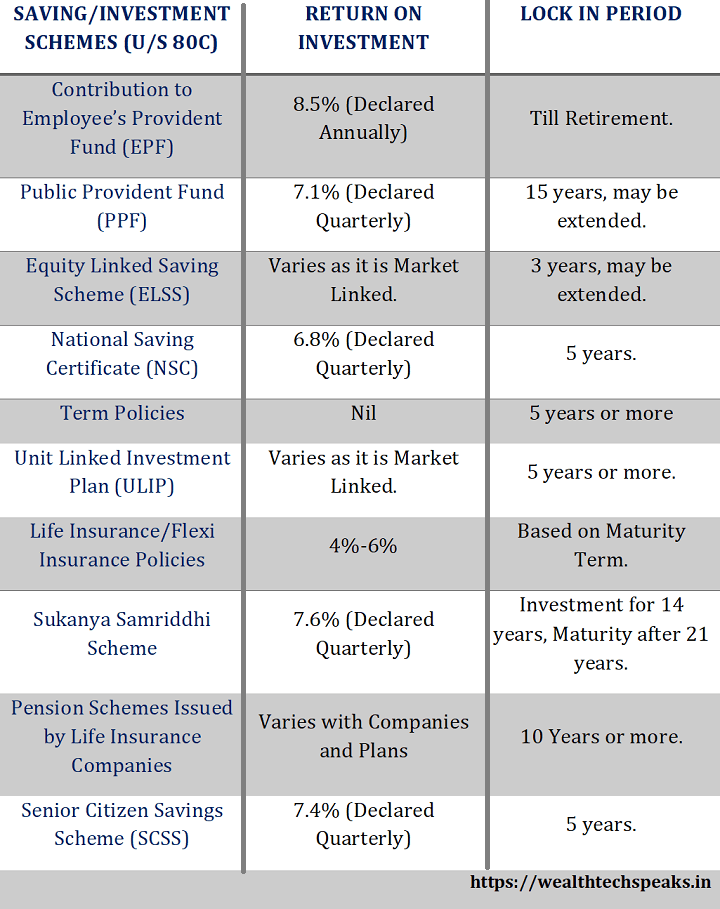

Income Tax Deduction Exemption Fy 2021 22 Wealthtech Speaks

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Section Wise Income Tax Deductions For Ay 2022 23 Fy 2021 22

Income Tax Deduction Exemption Fy 2021 22 Wealthtech Speaks

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Deducting Farm Expenses An Overview Center For Agricultural Law And Taxation

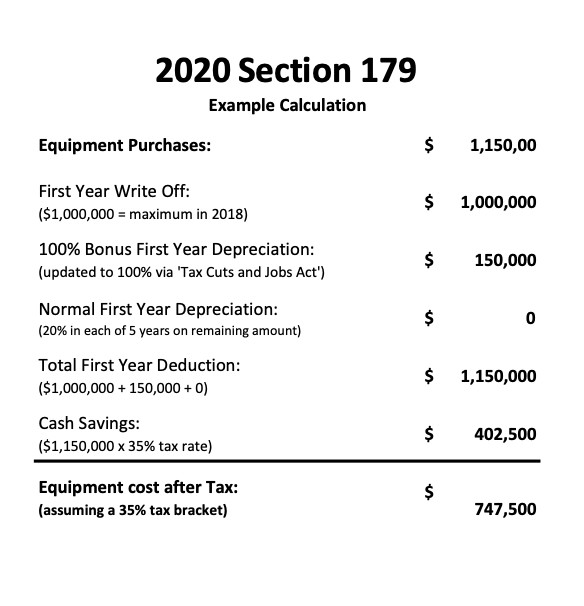

2020 Tax Code 179 For Business Owners The Self Employed

Bmw Over 6000 Lbs That Qualify For Tax Deduction X5 X6 X7 Tax Credit

Income Tax Deductions F Y 2021 22 A Y 2022 23 With Automated Income Tax Calculator All In One For The Govt And Non Govt Employees For The F Y 2020 21 Itax Software

2020 Section 179 Commercial Vehicle Tax Deduction

Income Tax Benefits Available To Salaried Persons For A Y 2022 23

The Ultimate Fleet Tax Guide Section 179 Gps Trackit

2020 Section 179 Tax Deduction And Bonus Depreciation Delta Modtech

Vehicle Tax Deduction 8 Cars You Can Get Free Section 179 Youtube

Maserati Section 179 Deduction For Vehicles Joe Rizza Maserati

Need A New Business Vehicle Consider A Heavy Suv Csh

Deducting Farm Expenses An Overview Center For Agricultural Law And Taxation

Post a Comment for "2022 6000 Gvwr Deduction List"